We are super excited to present this offering, and I am so bullish about where this will go! Before we jump into it though, let’s set the scene, and give props to huge inspirations behind this.

Setting the scene

FOMO Jim & I have struck up quite the bromance I mean working relationship in the last six months. We’ll take calls, usually after he’s been out for a morning surf, and just before he BBQs some shrimp on the beach with a cold VB. Strangely, I always seem to catch him as he’s about to rub tanning oil on himself. Despite the glare of the sun on his washboard abs, we make it through.

The conversation follows a familiar trajectory; super bullish on Radix Tech, and wondering how we can contribute to network growth. Often we circle back to the same theme; people get most excited when their portfolio is green. True, some people are price-agnostic tech evangelists, but for the masses to come here we need a compelling, often financial lure. In a word, profit. The sensation that we are $EARLY on a platform that is set for parabolic growth. The buzz that by being here now, we are moving towards financial freedom.

Recently however, for reasons that are beyond the scope of this piece, $XRD has crabbed or bled. Inevitably, the projects built here that are tied to $XRD, have struggled as well. Jim & I remain bullish on Radix, but have often wondered whether it’s possible to hedge these drawdowns, whilst retaining exposure to the upsides.

Inspiration

Two projects which we have huge respect for, and certainly informed our strategising, are Phoenix and $DAN. Phoenix with their Strategic Investment Fund, have been investing in ecosystem projects before it was cool. $DAN, like for so many things on Radix, were the first to do a passive income play - making investments on other platforms, then bringing those profits back to $DAN stakers here on Radix.

We took huge inspiration from both these projects when devising The FOMO $HIT Investment Fund, and so it’s only right to highlight that. This however is not a copy pasta. We’ve taken inspiration, pay homage, and do our FOMO $HIT.

The FOMO $HIT Investment Fund

It’s an investment fund, completely within Radix DeFi, that investors can get exposure to by staking to our node, and receive airdropped xUSDT in return.

When people stake $XRD to the node, fees are generated (in $XRD) as a reward for validating transactions on the network. Up until this point, 100% of fees generated went into buybacks of both $HIT & $FOMO, which got airdropped weekly.

With this Investment Fund, we will take some fees, and allocate them to interest-paying positions within the Radix DeFi Ecosystem, thus building an investment portfolio. Every quarter, 80% of this fund is paid out in proportion to the weight (time and amount) of those who are staked to the node. That means if one person stakes 1m $XRD for a month, and another person stakes 500k for two months, they would be weighted equally. The remaining 20% stays in the fund to compound.

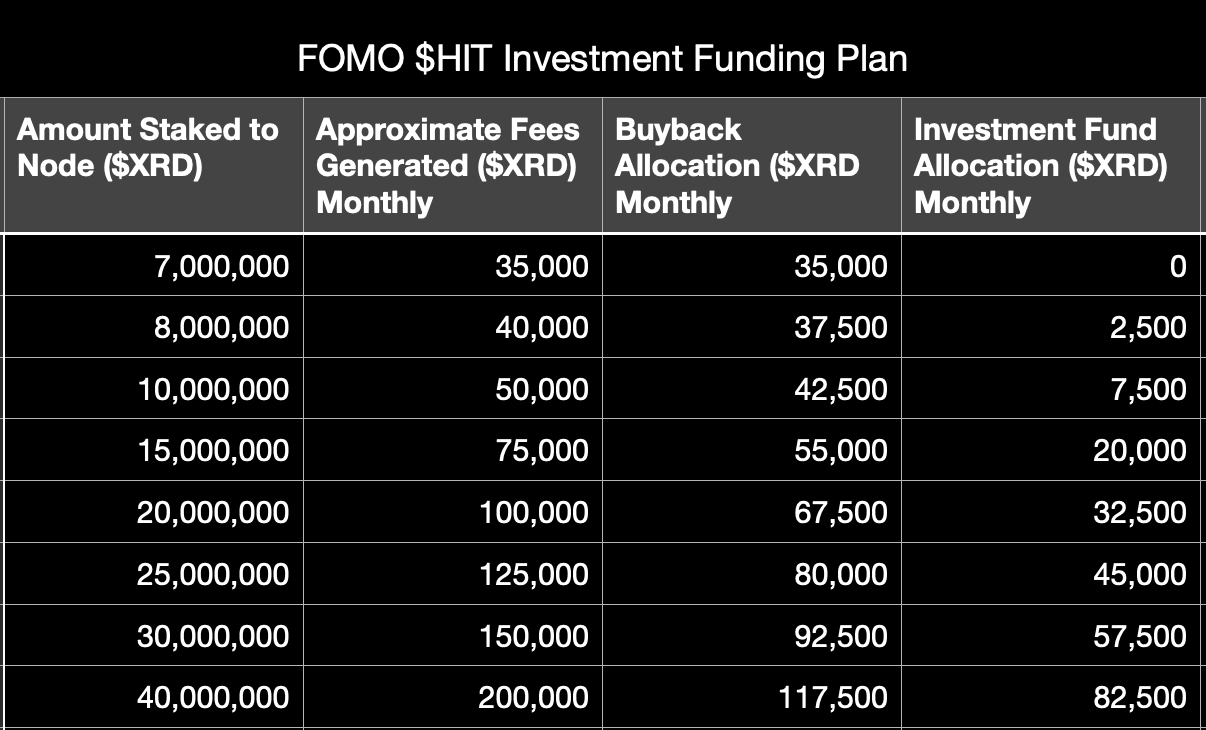

We have a commitment to the buybacks, and so have designed a strategy where buybacks will never decrease. Every $XRD generated in fees up to the 7m staked to the node at the time of announcement, will go to buybacks. Above 7m staked, half the fees will go to buybacks, with the other half going into The FOMO $HIT Investment Fund.

Ok, why is this exciting?

This is not just very exciting, we are genuinely buzzing about this!! Let’s go through, point by point:

Keep your precious $XRD

We love the tech, and truly believe in the long-term value proposition of $XRD. As such, any proposal that would involve selling $XRD was simply not something we wanted to explore. It’s a risk we didn’t want to take. With this strategy, you keep your $XRD, & simply delegate it to our node. As such, you can always unstake, and reclaim your $XRD whenever you like!

There is no “do I sell my $XRD?” question to entertain. We want to keep hold of our $XRD, and want you to be able to do the same!

Existing Revenue Stream

Interest-paying DeFi positions that we place are made with revenue generated from node fees. As such, this is as close to “Risk-Free” as is possible in this space. Of course, there are still risks with Smart Contract exploits, and there is always the opportunity cost of another, potentially better performing option. This option however does not require any new funds to be generated. It’s not a token, asking you to sell something to buy. Nor do you have to place positions yourself. We are able to do everything in-house, from the already existing revenues we have in place. It’s simply a case of the more funds deployed into this strategy, the faster the pot grows thanks to compound interest (moar below).

Hedging

The most successful hedge funds operate with a delta-neutral strategy. That is to say, whichever way the market moves, they have positions that balance each other out, so the net produces an overall positive picture. This is sometimes considered an “all weather portfolio”, because it doesn’t matter if it’s sunny or rainy.

Traditional Nodes on Radix have 100% exposure to $XRD price. You earn 6.5% interest, paid in $XRD. Therefore you are at the mercy of $XRD price. Market goes up? Great, your interest is worth more. Market goes down? Sorry, it’s worth less.

Some nodes, including ours, have detached from this slightly by using the fees to do buybacks, then pay out rewards in Alts. Many of these Alts outperform $XRD, and so the strategy is beneficial. However, these Alts still have their main liquidity pools in $XRD, and so remain tied to wider $XRD movements. As such, these are not all-weather.

By taking some of the fees generated, and hedging into other currencies including wrapped assets and stables, we start to spread the risk. This means if $XRD drops, we are holding other assets. These may retain their value in the case of stables, or fluctuate like other wrapped assets - however they are positioned within a lending DeFi position, earning interest.

Similarly, if $XRD goes up in value, great! We are earning more in fees which means we can deploy more into the fund, meanwhile the Alts that people receive in airdrops from staking to our node ($HIT & $FOMO) are likely to keep up or exceed $XRD in that scenario, as they have done in the past.

It's often said diversity is the only free lunch in finance, and we would structure the portfolio as such. Nom Nom Nom.

Liquidity

It was really important for us to keep everything within the Radix Ecosystem. We didn’t want to take value off-chain, as this would impact ecosystem liquidity. Liquidity within Radix is already small, and we didn’t want to entertain the idea of negatively affecting this. Thanks to Anthic, and wrapped assets, this is now not a problem we need to solve. We can keep everything within Radix, and get exposure to other assets, as well as stables. As we grow, we can begin to meaningfully contribute to platform liquidity, win win!

Compound Interest

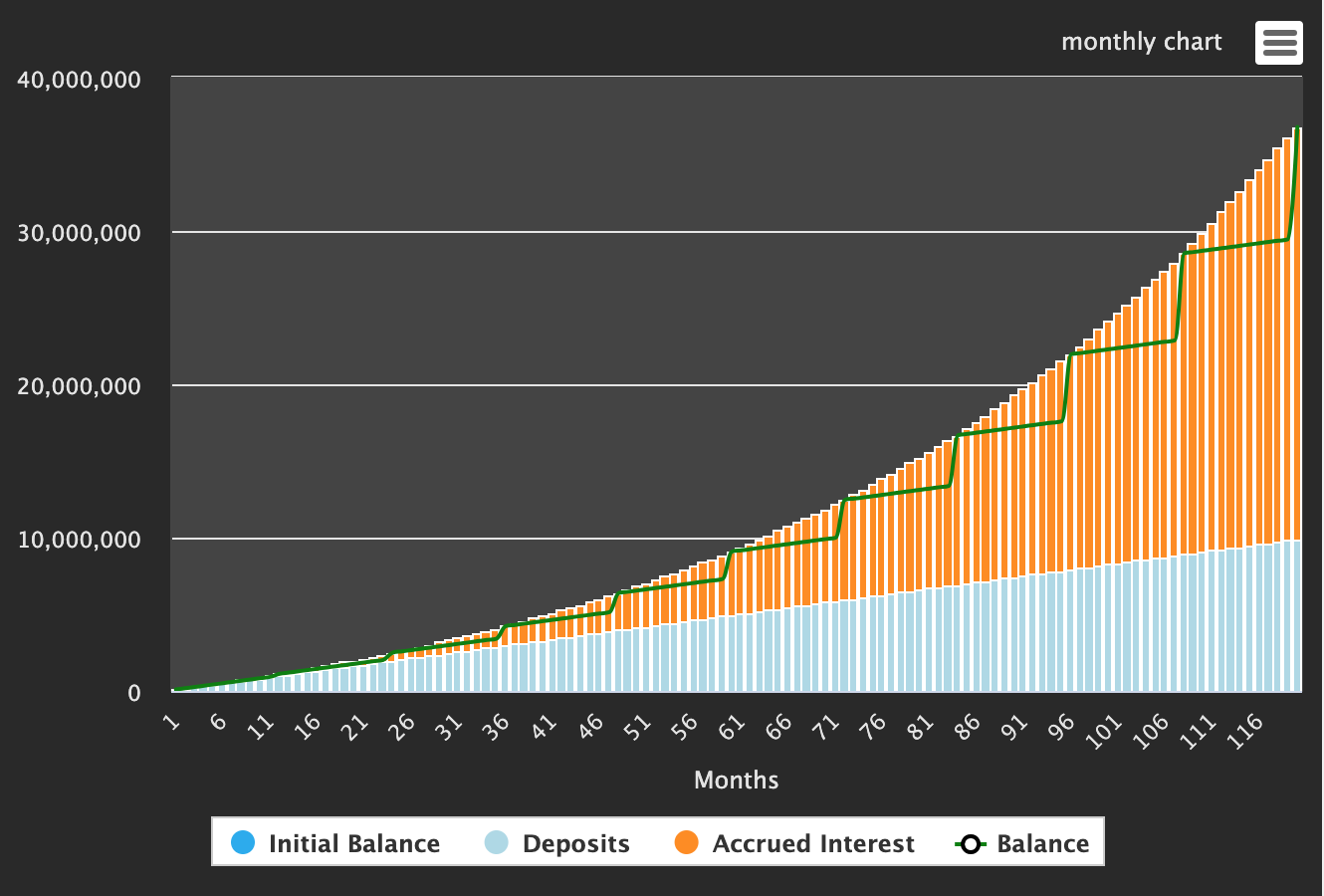

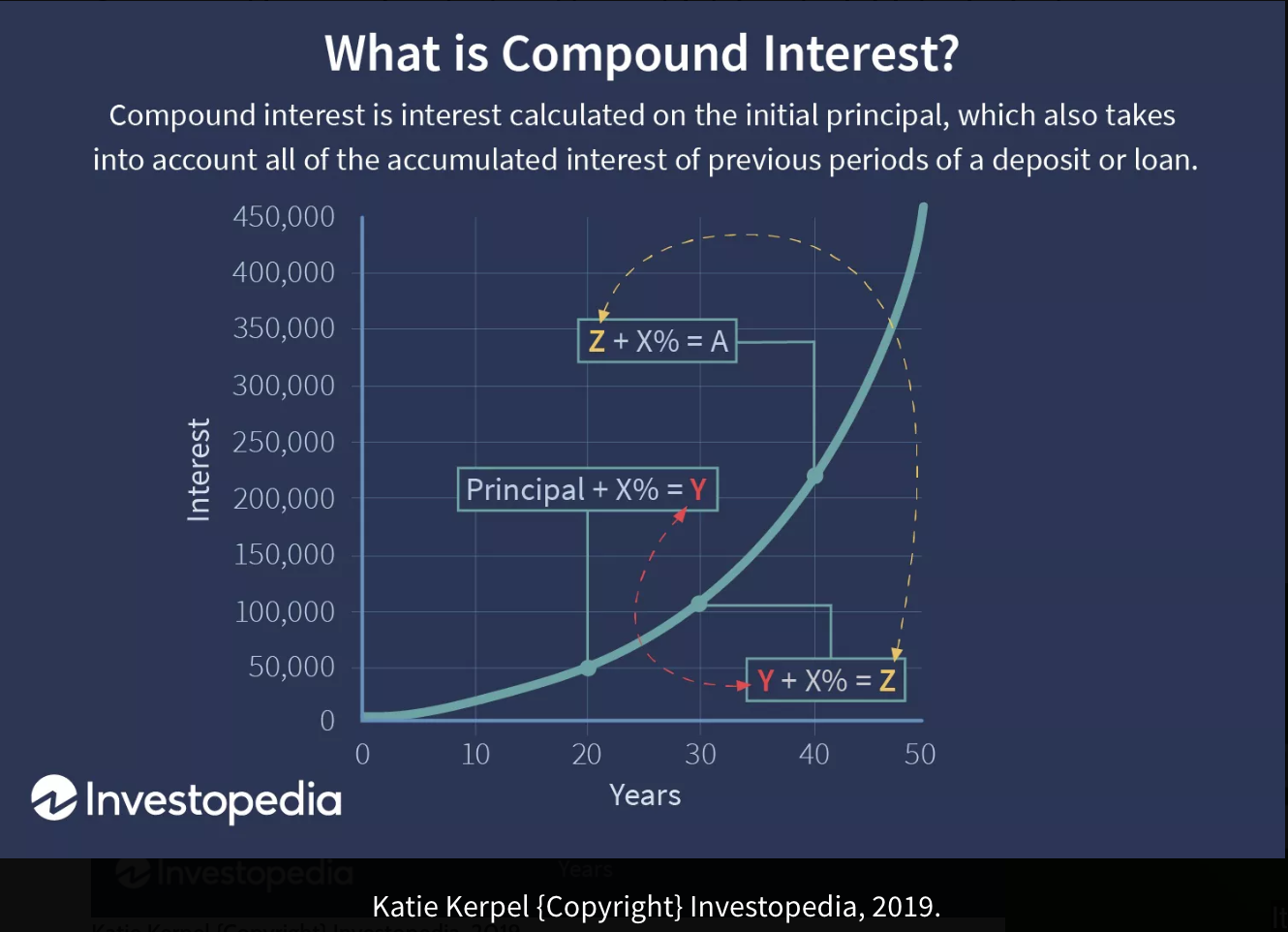

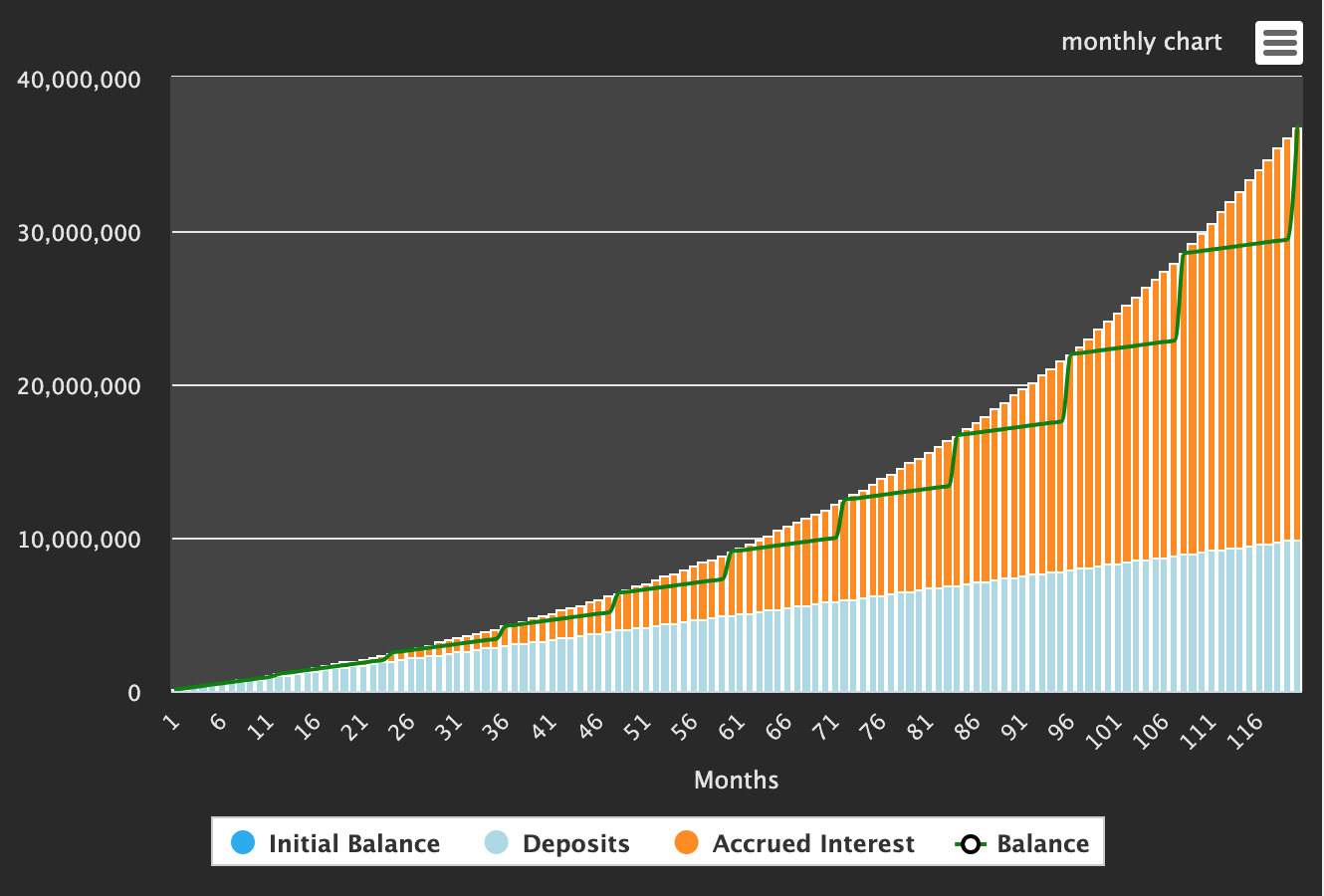

There’s a quote attributed to Einstein, that Compound Interest is “The 8th wonder of the world, he who understands it, earns it. He who doesn't, pays it”. Compound interest is fucking exhilarating, but it requires two things; patience & capital. It’s the very simple idea that the interest you earn on your initial, will then also begin to apply to the interest you accrue. So on a long enough time period, and with decent investment, number go up. Fast. It’s much easier in a graph.

That people don’t take more advantage, especially in this sector, is down to a couple of things. Firstly, this is crypto, and people want life-changing sums of money yesterday, or in a few years. Not in 5 to 10 years plus, it feels like too long to wait for most. Secondly, it’s kinda boring. It doesn’t go up 10,000% in a few months like the new hottest meme coin. It’s slow and steady, but it often wins the race. This is a more mature strategy, that will give us exposure to the wonder that is compound interest.

It’s also worth noting, the take-off is likely to be sooner than that of the graph above. This is because the DeFi ecosystem is crying out for liquidity, and so is paying anywhere from 10-50% APY for lending assets! The fact this opportunity exists is incredible, and we are positioning ourselves to take full advantage of it!

Plan

Having started the fund with 10,000 $XRD on 17 January 2025, split evenly in xUSDT between Weft and Root Finance lending platforms, the plan is to add 50% of all additional fees generated from the node to this portfolio. As we grow, the portfolio will include other DeFi platforms within the ecosystem, and other assets as well as stables.

We will begin work to include a “FOMO $HIT Investment Portfolio” page to our website too, where people will be able to see what the portfolio holds, and the total amount.

We plan for this to be led by community, and if there are strong calls for the frequency of payouts to be changed, or the payout:reinvest ratio to be adjusted, then those are variables we would be happy to adjust accordingly.

Vision

My vision with this is never having to cash out. I’ll explain. One of the major sources of stress and anxiety within crypto is “how do I turn these numbers on a screen in a strange currency, into money in my account?”. And it’s not just how, it’s when, too. At what point do you cash out, what percentage do you cash out, and the anxiety with inevitably not timing the market properly!

With this fund, the vision is that as Radix grows, and as the fund grows, we would essentially be paying quarterly dividends, in a stable asset, with your $XRD safely in your wallet, having not sold a single one.

If $XRD manages to revisit ATH, or enters price discovery mode, then this portfolio would be acting as a way of taking profits, without ever exiting your initial position.

Assumptions:

10,000 $XRD to start, 25% annual APY (well within current range), 82,500 $XRD added to fund each month (achievable when node has 40m staked). There is 650% growth over 10 years, without selling a single of your $XRD. How we take dividends would be up to the community. Yes, the Y-axis is $XRD, it really does compound to that amount!

Can I not just do this myself?

Yes, of course you can. But it would involve selling your $XRD to get the position started, then managing DeFi positions, and ultimately deciding when to cash-out. The great thing about this fund is your $XRD stays in your wallet, and you get exposure to the fantastic APY opportunities within the ecosystem, then receive your quarterly dividend.

The fund could even pursue a more aggressive payout:reinvestment strategy, say 60:40 or 50:50, which would admittedly mean smaller payouts for the first couple of years, but would grow the investment fund in the long run. Again, all without selling a single of your precious $XRDs

Closing Thoughts

By staking $XRD to the 💚ADDIX+FOMO🐸 Node, you are part of The FOMO $HIT Investment Fund, and have a more balanced exposure to the wider crypto & DeFi market. Beyond 7m staked, 50% of fees go to buybacks of $HIT & FOMO with weekly airdrops, giving you Alt coin exposure. The other 50% goes into DeFi positions within the ecosystem, paying quarterly dividends in xUSDT, providing you a way to take profits, in a stablecoin, without ever touching your $XRD.

We are super bullish on the future of DeFi taking place on Radix, and are proud to be building the first Investment Fund on this platform.