“the question remains, when is radix going to step into the spotlight? My normal answer to this is soon…however in the next 5 minutes I’m going to answer why soon, is 2024” - Piers Ridyard

This was the first announcement of Breakout 2024. In this post we’re going to look at where we are with the areas outlined in the vlog.

Before we begin, a disclaimer on timing. Breakout 2024 was announced in early March, so we were already a couple of months into the year. It could be argued the mid-point should then be August? End of June would be the typical midpoint, so the start of June is a touch premature, but as I reassure my girlfriend, it is purely because I am excited. Sort of like the Bavarians beginning Oktoberfest in September. After all, being $Early is in our culture. Right then let us, in the timeless words of DX, Break it Down

Massive liquidity growth

“Finally, trustless bridging of your assets into radix”

Definite progress here, with Maya Protocol approving Radix integration for cross-chain liquidity. Maya specialises in decentralised liquidity and facilitating swaps across various blockchains - like Uniswap is to Ethereum, but cross-chain. This one is too early to judge; we first need integration, and later to see the effects this bridge has, but it’s a very promising start, and with most of the year to go, we should be on course. 5/10

Project ignition

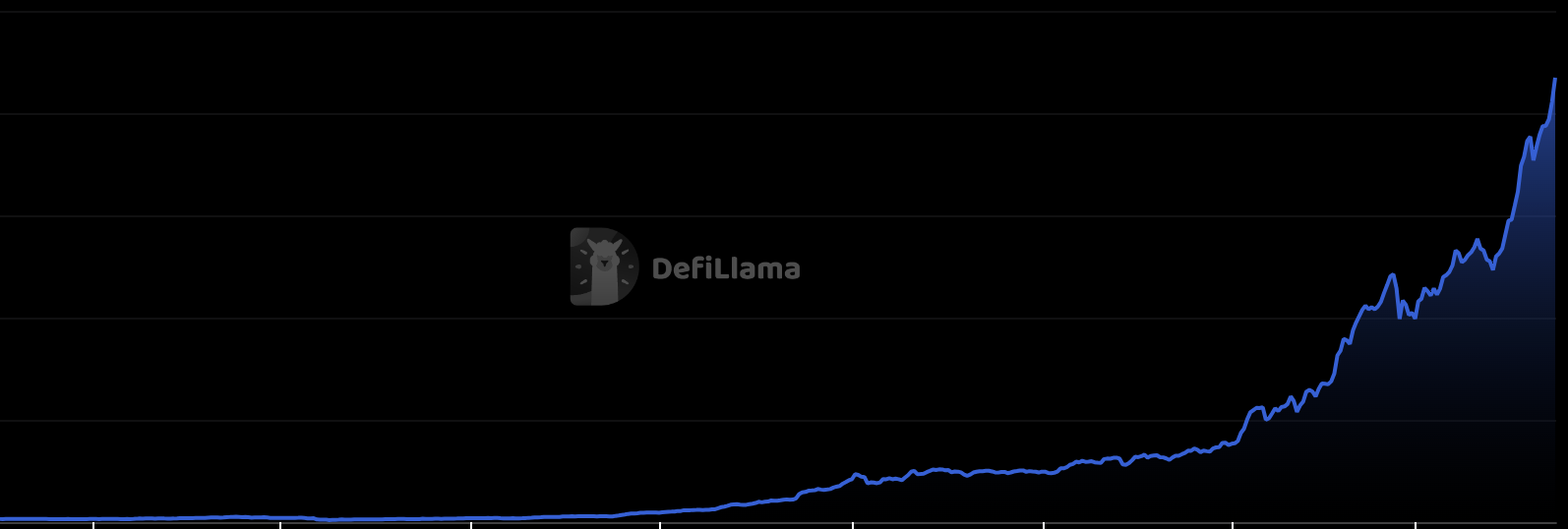

On 14th March, Radix announced Project Ignition with $10m in liquidity incentives. Essentially, liquidity in one of xUSDC, xUSDT, xwBTC, or xETH could be added to an Ignition Pool within a DEX, and for every $1 of wrapped asset added, Project Ignition supplied an equal amount of XRD on the other side. The idea being this would turn the $10m pledged into $20m when fully claimed. What made this pretty unique, was impermanent loss (IL) protection was provided. The user would contribute only the non-XRD side, and in negative performance scenarios of the XRD token, the liquidity provider was covered. As a sweetener, if users locked up for 12 months, they would receive 20% of their XRD upfront.

Project ignition saw Total Value Locked (TVL) increase 76%, from $30m on 14th March, to $53m on 28th March. Interestingly, the Ignition bonuses for xwBTC xETH were all claimed by the end of March, with bonuses only remaining available for xUSDC and xUSDT pools, ie users of Project Ignition were bullish!

TVL within Radix currently stands at $34m, the drop largely to do with XRD’s current value at $0.04. Ethereum has the lion’s share, with 60% of TVL. Radix ranks 25th for Non-EVM chains. Although the total fund bonuses weren’t claimed, and the TVL currently is comparable to before Project Ignition, with such a staggering increase in TVL after the launch, we have to call Project Ignition a success. 8/10

Multi-million $$ Ecosystem Funds

“real money being put behind the fantastic builders in the radix ecosystem”

Very recently we had huge announcements that showed this. On May 29th the Radix Foundry was announced, followed by The New Radix Ecosystem Fund on 30th May, but what exactly are these?

Radix Foundry: Up to $250k in funding, and marketing, business, and technical support from RDX Works for dApps in high-potential categories. This incubator is aimed specifically at a few areas, including lending and borrowing markets, real-world assets, yield derivatives & stable coins. Think Y-Combinator, but for the Radix Ecosystem.

New Radix Ecosystem Fund: 250m xrd ($10m): This fund includes the foundry, but has scaled up the booster grants over tenfold, from $15k to $160k, providing support to projects at every stage of their development.

What has been done really thoughtfully here, is the money isn’t earmarked. There is huge flexibility for projects to apply, whether they are looking to scale up, or still at the idea stage. A superb initiative, with strong financial backing, designed to strengthen the entire ecosystem. 10/10

Institutional capital

Piers spoke about institutional capital - as of now, we are yet to see that. But, most of the year is still ahead of us, so we will consider this a request for an extension, and hold off giving out a grade here.

Massive Scalability Tests

Breakout also promised a throughput world record attempt, unfortunately also referred to as “Cassandra being properly stretched”. Talking TPS and Swaps, we have been delighted with the near daily updates from Cassie. Dan has been smashing it in the lab, and as of the time of writing, community tests have demonstrated >100k Swaps, and 200k TPS. Because of the nature of these tests, we are getting to witness the scale up in real-time. There is even a community-made dashboard being built so those of us not participating can follow along. At this rate, 1m TPS demo will very soon be a verifiable reality. 9/10

Mobile-to-mobile dApp Connectivity for the Radix Wallet

So far there is only one example of this; WOWO Tip Bot. This came out just over a week ago, and is a fantastic piece of tech, gifted to the ecosystem by Ward, Daan and the WOWO team. A tip request is made in Telegram, then when going to your wallet, a transaction manifest magically appears, for the tx to be signed, before going back to telegram to see the pending change to confirmed. It’s a quite brilliant example of the power of Mobile-to-Mobile dApp interaction, and if those that follow are even half as good as this, then we are in for an absolute treat! A very optimistic and forward-looking 4/10

Seed-phrase Free Web3 experience

No news yet. No extension granted. 0/10

Massive user-base scale-up

“start of campaigns to massive scale up user base; wallet, ecosystem apps, and more."

With Token Trek announced on May 23rd, we are two weeks into the very start of the user-base scale-up. By its own accounts, Token Trek is an MVP, powered by DMany, with the intention of onboarding users to the ecosystem through a gamified series of quests and challenges. With 120k XRD in rewards, plus tokens from 15 dApps and increasing, users are encouraged to download the Radix Wallet, get interacting on socials and on-chain.

In the first week since launch, Token Trek has seen 10,000 registered users, and 25,000 completed tasks, with all participating projects seeing a leap in their engagement. On 27th May, total Radix Wallet downloads surpassed 50,000 - a huge milestone. This stood at 20,000 on Feb 14th, so we have more than doubled in 3 months. The start of this user scale up is looking very promising indeed. 7/10

Massive breakout dApps

Piers spoke about dApps breaking out from Radix, and “reaching out into the world”. So far, I would argue only Selfi Social has built anything that is capable of achieving that. Selfi is a brilliant chrome extension that allows users to connect their Radix Wallet and identity to their Twitter profile, and begin to socially trade, stake and more. An outstanding dApp, built by one lad, with enormous potential to be disruptive. Similarly to Mobile-to-Mobile above, if this is the start of a wave of similar dApps, then we have a lot to be excited about.

Not a dApp per se, but Radix being selected by the University of Surrey as the only Blockchain capable of handling their novel Carbon Tokenomics Model is a bullish example of Radix breaking out from the degen-dominated crypto-sphere, and adding serious real world value, under the hood. With these two projects trailblazing, we give a similarly optimistic 5/10

Big Red Marketing Button

“multi-million dollar user onboarding campaign, developed with an award-winning mobile game studio”

Perhaps the biggest meme of the “Wen Marketing?” question was just when we could expect the Big Red Button to be pushed. This was to bring people from “no awareness to confidently using Radix”. The button hasn’t yet been pressed. It’s difficult to speculate why not - presumably trying to time the campaign with new tech, wallet upgrades, MFA, key listings, who knows. This would make sense, to try and maximise exposure, but for now, we have to be honest and give this 0/10.

Key exchange listings, oracles, custody providers

On 9th May, Radix made what proved to be a polarising decision to announce that an application for Binance had been made. Personally, I don’t see this as a bad update, and would take some news over no news. By my rough-cut observations, the people who were most vocal about “Wen Binance?” seem to be the same people annoyed with this news!

Announcement of an application is not however a listing. Similarly, there has been no Oracle news since December 7th 2023 when Supra integration was announced, and no word on Custody Providers recently either. 1/10

Conclusion

So there you have it, Radix’s Mid-Year Review. As expected, some areas have made more progress than others. Speaking to Dan on Friday in Radix Review, he made the fair point that we are likely to see a snowball effect in the second half of the year. That is to say, progress will not be linear. As we see advancements in some areas, they will feed into the growth of other areas, which will in turn accelerate the progress. This is sometimes known as the flywheel effect. We are already seeing this in action, with the amount of dApp releases incomparable to the first couple of weeks after Babylon launch.

When beginning this review, I thought we were going to be lagging behind. However looking at what’s already been achieved, what’s in the works, and the likelihood of developments snowballing, I have never been so bullish on Radix as I am right now!